보도자료·발표문

Survey of Top 500 Companies' Domestic Investment Plans for 2024

|

Business uncertainty making it hard for

large corporations

to plan investment in 2024

-

Top 500

Companies' 2024 Domestic Investment Plans Survey –

•

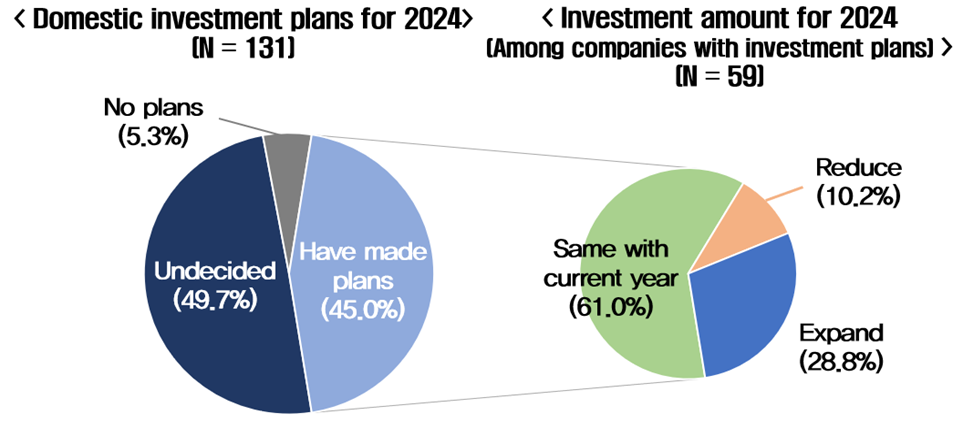

Investment in 2024: ‣Undecided

49.7% ‣Planned 45.0% ‣No plans 5.3

•

Investment size in 2024 for companies with plans (45%): ‣Same as this year 61% ‣Increase 28.8% ‣Decrease 10.2%

•

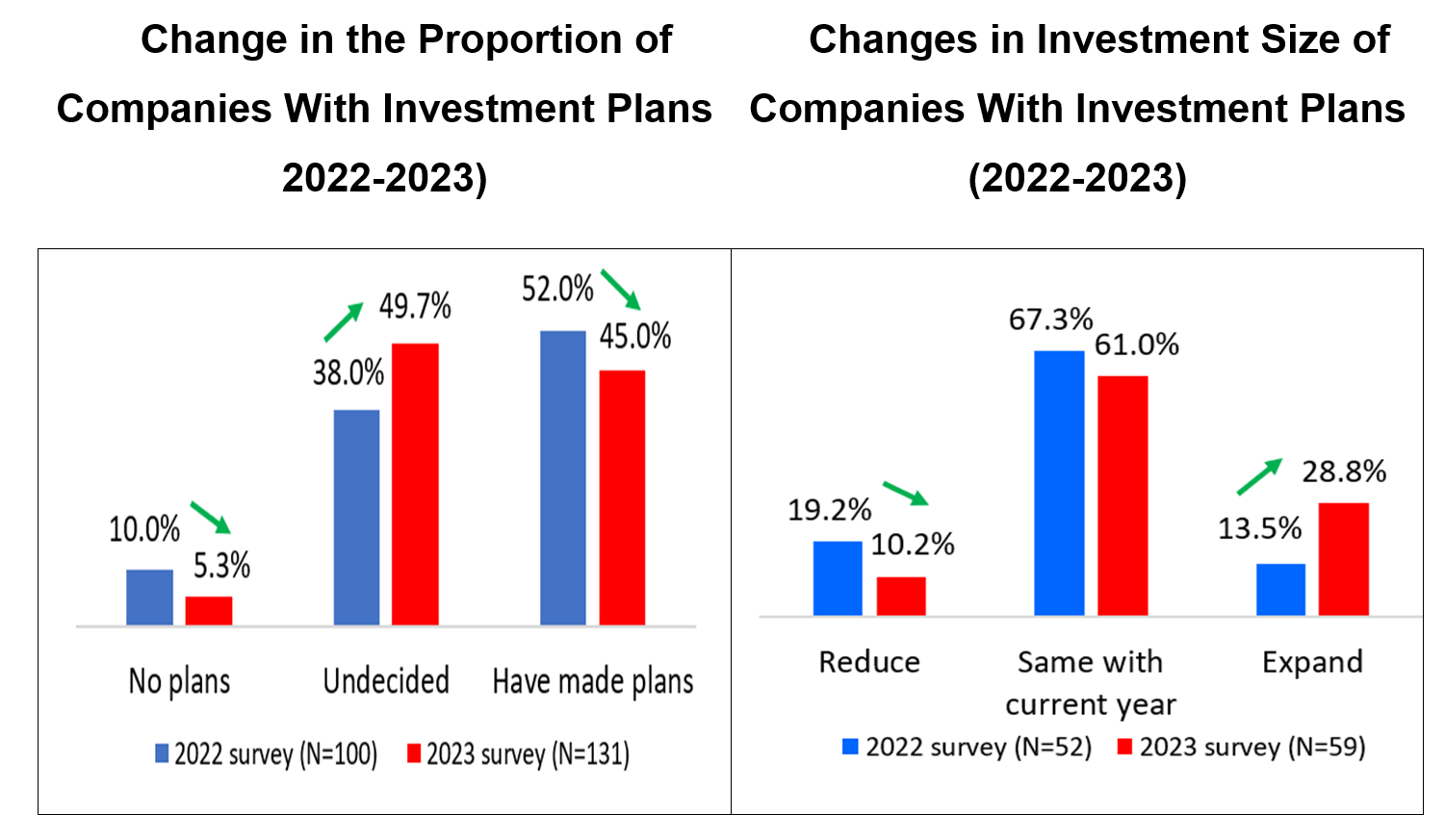

More companies increasing investment and fewer companies reducing investment compared to last year’s survey

•

Proportion of increasing vs decreasing investment (among companies with investment plans):

•

Increase 13.5% (2022 survey) → 28.8% (2023 survey)

•

Decrease 19.2% (2022) → 10.2% (2023)

• Expected investment period: 2nd half of 2024 (32.8%), 1st half of 2025 (15.3%)

• Policy needed to support investment: Interest rate reduction(28.8%), tax support (22.6%)

As the economic outlook for

the coming year remains unclear1 due to continued domestic and

global uncertainties, including high interest rates, a weak Korean won, wars in

the Middle East and Ukraine, and a slowdown in China's economic recovery, more

than half of large companies surveyed do not have investment plans for the

coming year yet. However, there are some positive signs, as among the companies

that do have plans, the proportion of companies that expect to increase

investment in the coming year more than doubled compared to last year.

1) IMF economic growth forecast downgraded (July → October): (World) 3.0% → 2.9%, (Korea) 2.4% → 2.2%

[Domestic investment

plans for 2024] ‣Undecided 49.7% ‣Yes 45.0% ‣No 5.3%

[Among companies with plans] ‣Expand' (28.8%) exceeds ‣Decrease' (10.2%) for investment in 2024

The

Federation of Korean Industries (FKI) commissioned Mono Research to survey the

domestic investment plans of the 500 largest Korean companies in terms of

revenue and found that 55.0% of the respondents (131 companies) have not made

their investment plans for next year yet (49.7%) or have no investment plans

(5.3%).

Of the companies that have made investment plans (45.0%), the majority (61.0%) said they will invest about the same amount next year, with more companies (28.8%) saying they will invest more next year than companies (10.2%) saying less next year.

2024 Domestic Investment Plans of Top 500 Companies by Revenue

Compared to the previous year's survey, the proportion of

companies that are set to increase investment increased and the proportion that

are set to reduce investment decreased

Compared to the results of last

year's survey (Dec. 2022), the proportion of companies with undecided

investment plans increased (38.0→ 49.7%), but among companies with investment

plans, the proportion of respondents increasing investment increased significantly

compared to last year (13.5% → 28.8% 15.3%p↑), while the proportion of

respondents reducing investment decreased (19.2% → 10.2% △9.0%p↓).

FKI interpreted these results as indicating that while many companies are still postponing investments due to the uncertain business environment, more companies than last year are willing to increase their investments to improve their competitiveness and prepare for future market changes.

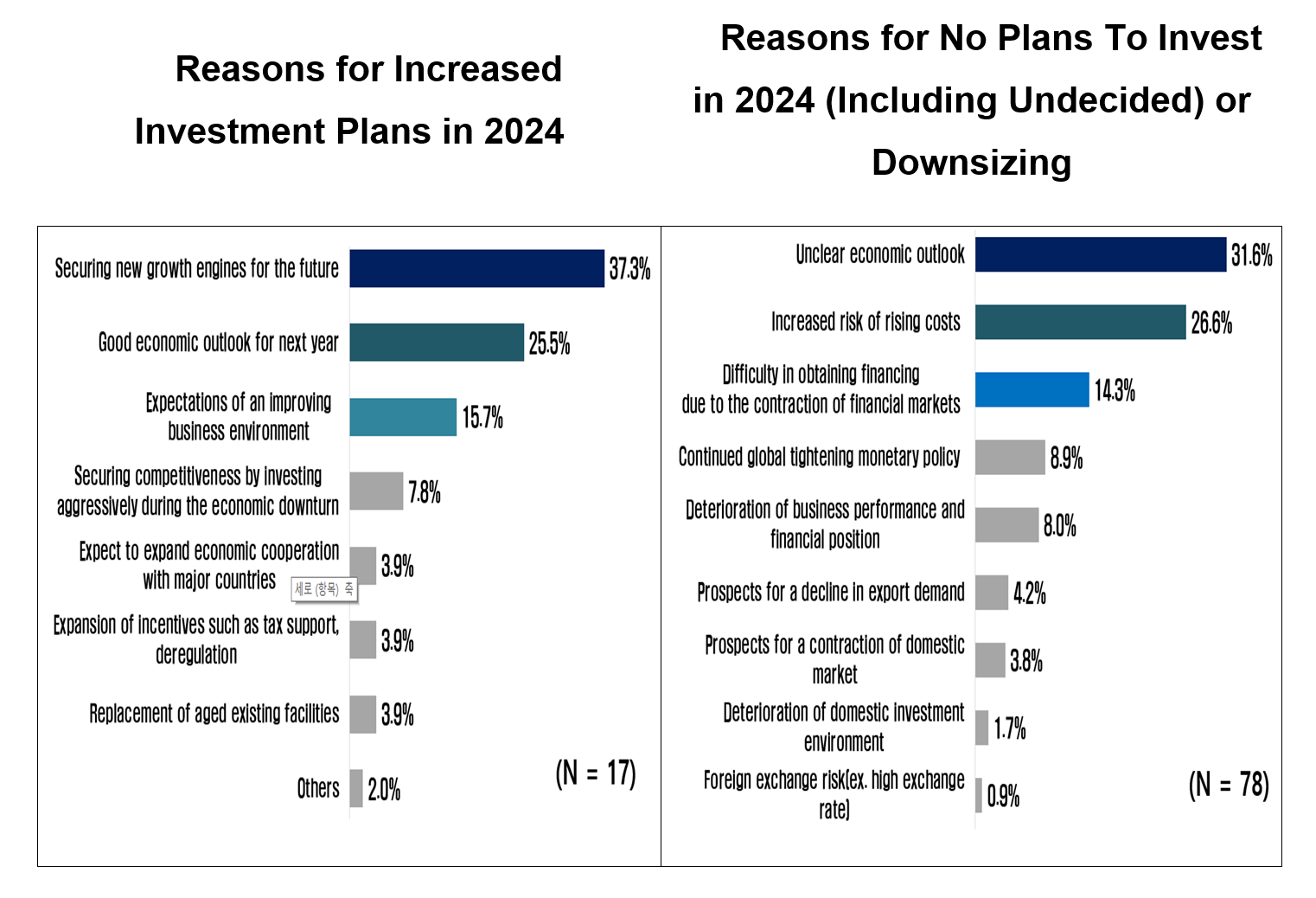

Top reasons for increasing investment: securing growth

engines (37.3%), good economic outlook (25.5%)

Top reasons for reducing investment: unclear economic

outlook (31.6%), risk of rising costs (26.6%)

Companies planning to increase

investment next year cited securing new growth engines for the future (37.3%)

as the main reason, followed by a good economic outlook for next year (25.5%), expectations

of an improving business environment (15.7%), and securing competitiveness by investing aggressively

during the economic downturn (7.8%).

On the other hand, companies that plan to reduce investment in the coming year or have no investment plans (including undecided) cited an unclear economic outlook (31.6%), increased risk of rising costs (26.6%), and difficulty in obtaining financing due to the contraction of financial markets (14.3%) as the reason.

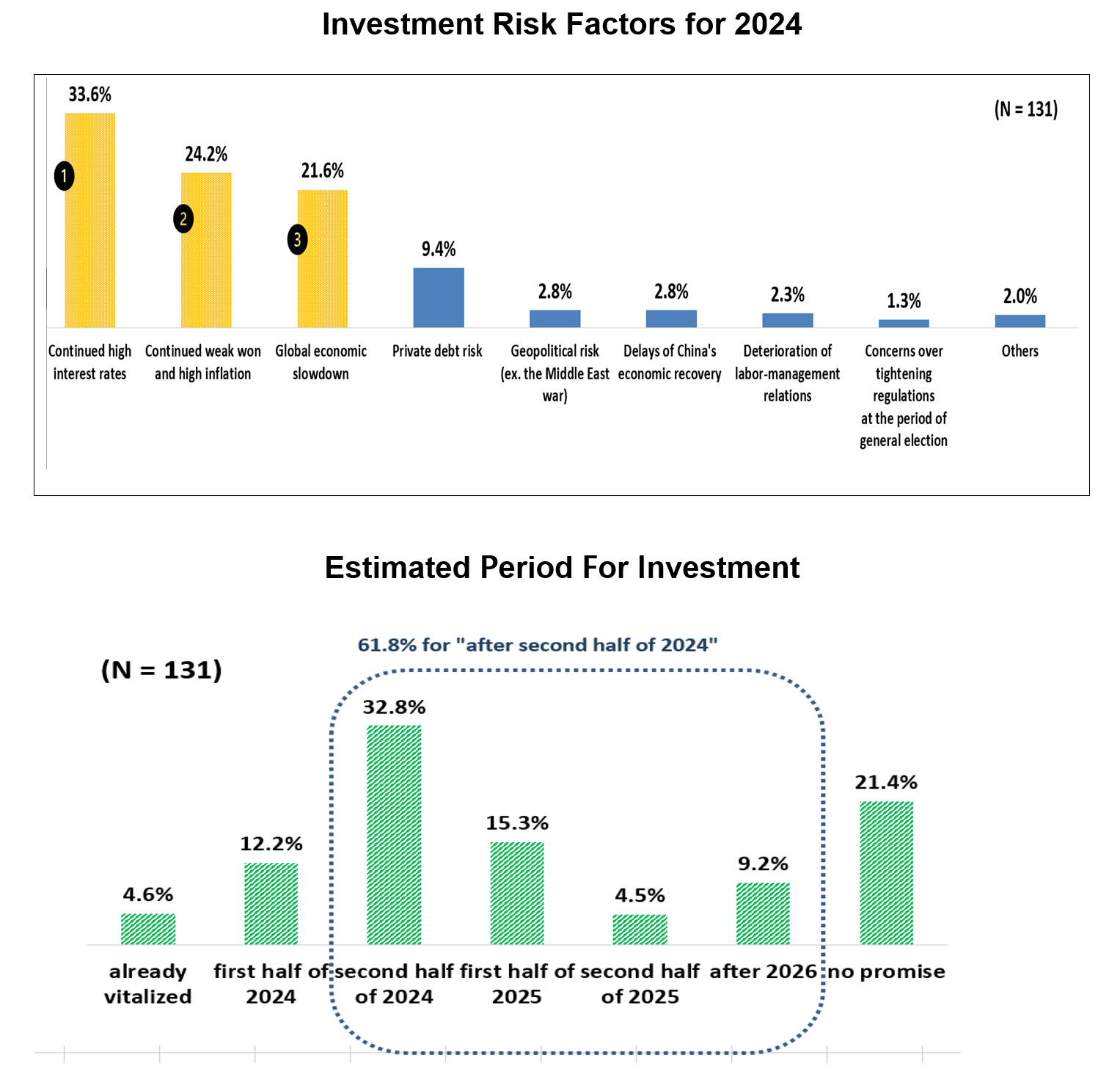

Top 3 investment risk factors in 2024: ① high interest rates ② weak won and high inflation ③ world economic slowdown

Expect to make investment in or after H2 2024

Among the risk factors that are

expected to negatively impact business investment activity in the coming year,

continued high interest rates (33.6%) was the most common answer, followed by a

continued weak won and high inflation (24.2%), global economic slowdown

(21.6%), and private debt risk (9.4%).

"Although inflation has

recently entered a stabilization phase2, it is still above the Bank

of Korea's target level (2.0%), and the prospect that the high interest rate

environment may continue for the foreseeable future is weighing on business

investment," FKI said.

2) Consumer price inflation

(Statistics Korea, year-on-year): 0.4% (2019) → 0.5% (2020) →2.5% (2021) → 5.1% (2022) → 4.7% (Q1 2023) → 3.2% ('Q2 2023) → 3.1% (Q3 2023)

When asked when they expect the

economy to recover and when they would make their investment, one in three

companies (32.8%) said the second half of 2024, followed by 19.8% for 2025 (H1 15.3%

+ H2 4.5%) and 12.2% for the first half of 2024.

Lower interest rates, more tax incentives, and less

regulation are needed to improve the business investment climate

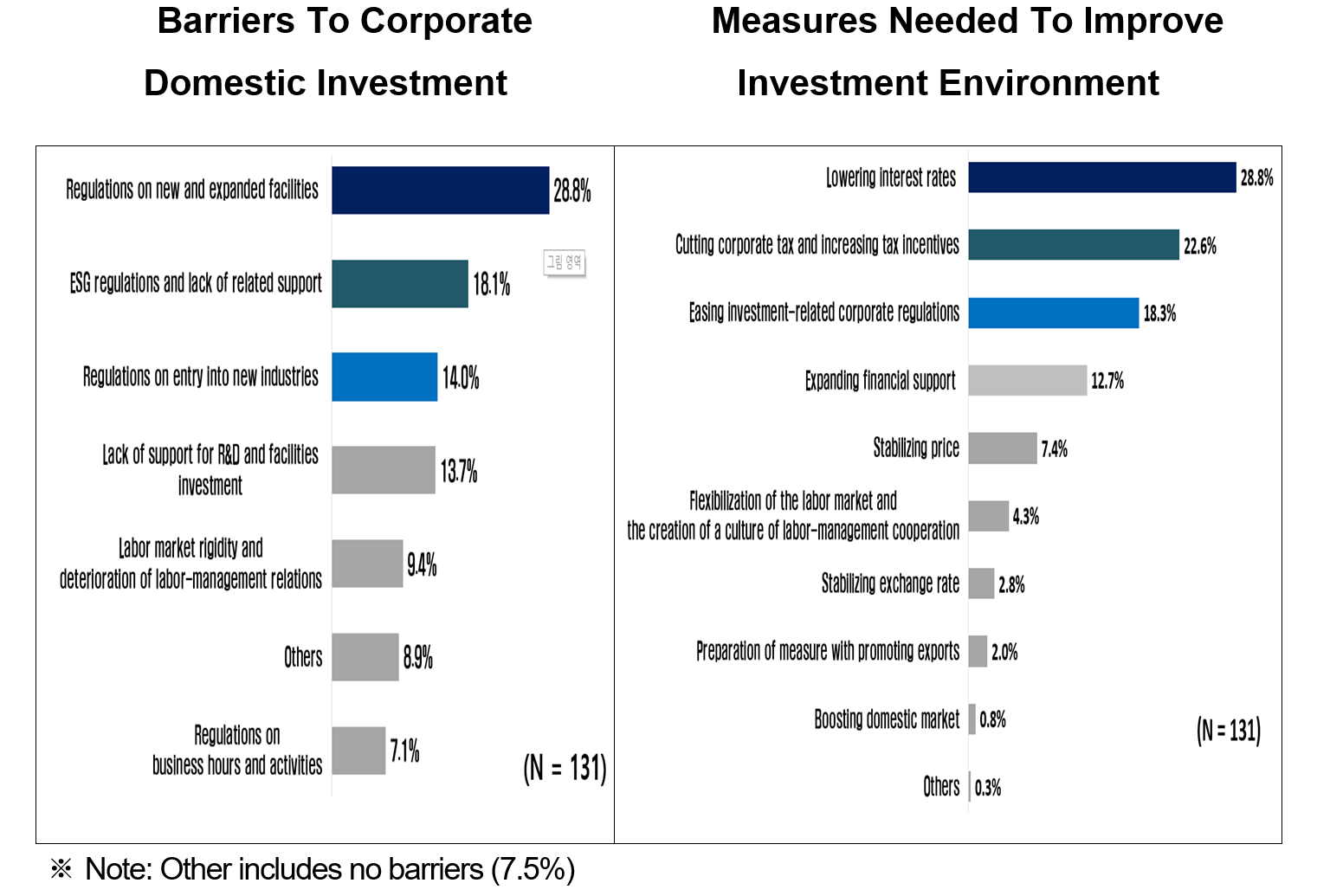

Currently, the biggest difficulty

companies reported facing when investing is regulations on new and expanded

facilities (28.8%), followed by ESG regulations and lack of related support

(18.1%), regulations on entry into new industries (14.0%), and lack of support

for R&D and facilities investment (13.7%).

For key policy issues to improve the investment environment, businesses cited measures such as lowering interest rates (28.8%), cutting corporate tax and increasing tax incentives (22.6%), followed by easing investment-related corporate regulations (18.3%) and expanding financial support (12.7%).

"Despite difficult business

conditions such as continued economic uncertainty and poor financial

performance3, the increase in the number of companies planning to

expand investment compared to last year is an encouraging sign for the Korean

economy," said Kwang-ho Choo, senior director of the FKI’s Economic &

Industrial Division. "In order to turn around the investment sentiment, we

need to continue institutional improvements such as deregulation and urgently

come up with financial and tax support measures to improve the difficult

financial situation of companies."

3) Revenue and operating income of

the top 100 companies (excluding finance companies) decreased by 6.0% and

20.5%, respectively, in Q3 (based on consolidated financial statements, source:

FKI)